The Government is planning to launch Singapore Savings Bonds in the second half of this year to offer retail investors an affordable and flexible option to park their money in low-risk government bonds. The Sunday Times takes a closer look at the new bonds.

|

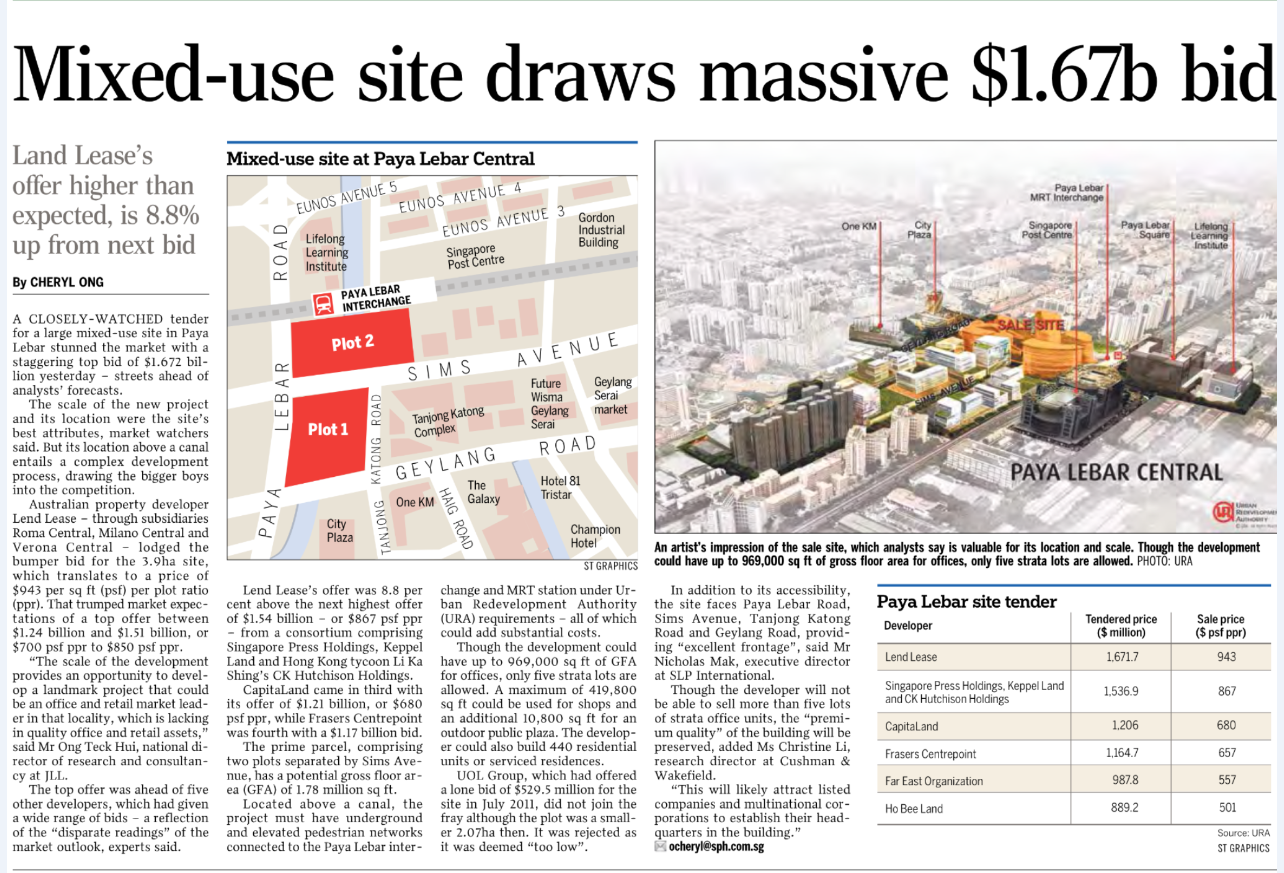

| Singapore Saving Bonds (SSB) Government Bond compared with Banks Savings and Fixed Deposit |

What are Singapore Savings Bonds (SSBs)?

Bonds are issued by governments and companies to raise money. Investors who buy them get regular interest payments and eventually get their capital back.

The new government-guaranteed bonds will be sold only to individual investors, and will be issued once a month, the Monetary Authority of Singapore (MAS) said in a briefing on March 30.

They will pay out interest every six months according to a rate which is based on the interest rates of Singapore Government Securities (SGS) bonds.

But unlike SGS bonds, which pay a fixed interest every year over the life of the bonds, SSBs will start with a smaller yield that will keep rising the longer an investor holds on to them.

They are also quite flexible. While SSBs have a tenure of 10 years - which means they will mature in 10 years - an SSB holder is allowed to get his money back any time, with no penalty imposed, so he does not have to decide upfront the duration of his investment. However, he will earn less interest than if he had held the bonds for 10 years.

To make the new bonds more affordable, SSBs' minimum investment amount is set at $500, with subsequent multiples of $500, up to a cap.

The MAS said it will provide details on the cap, methods of purchase and date of availability in the coming months.

How much return will you get from SSBs?

SSBs will generate interest return - or coupon - on a rate linked to SGS bonds, but with a unique "step up" feature.

The average coupon that an investor will receive over the period he holds SSBs will match what he would have received had he bought SGS bonds maturing over the same period.

As SGS bonds offer higher returns for a longer pe-riod - which could range from one year to 30 years - the peg with SGS bonds means that SSBs will initially generate a smaller coupon, but the amount will increase the longer an investor holds onto the SSBs.

If an investor holds the SSBs for their full 10-year tenure, the total coupon he receives will match the return of 10-year SGS bonds. Currently, these are yielding about 2 to 3 per cent return annually.

To illustrate: An SSB investor who holds the bonds for one year may get a coupon of 0.9 per cent.

If he holds them for two years, the second-year return will be 1.5 per cent, so that the first two years' return will be an average of 1.2 per cent. If the bonds are held for up to 10 years, the 10th year will pay an interest of 3.3 per cent so that the investor's average annual return is 2.4 per cent, matching the coupon of 10-year SGS bonds.

An investor can cash out on his SSBs any time he wants, subject to a one-month window.

In return, he will receive his principal sum, which is guaranteed by the Government, along with whatever accrued interest he has earned.

In essence, the "step up" feature encourages investors to hold SSBs for as long as possible. Early redemption of the bonds will not incur any penalty but the return earned will be lower.

What are the pros and cons of SSBs?

SSBs combine the flexibility of a short-term investment, the affordability of a low-cost product, and the stability of a long-term government bond.

Most of the time, a bond investor has to choose his bond tenure and lock his money in. He cannot cash out until the bonds have matured, but is allowed to trade the bonds on the stock market.

Trading comes with the risk of price fluctuations.

SSBs will not be traded and there is no risk that an investor gets back less than his investment.

The flexibility also gives SSBs an edge over a fixed deposit with a bank, which pays no interest if the principal is withdrawn before the account's maturity.

SSBs' minimum investment at $500 is also more affordable than many other financial products. SGS bonds require a minimum investment amount of $1,000 while most banks require $1,000 to $5,000 in minimum savings for a fixed deposit.

Also, SSBs can be seen as an extremely safe investment as they are backed by the Singapore Government just like SGS bonds, which have the top AAA credit rating with all key rating agencies.

However, SSBs have some drawbacks compared to other time financial products.

Unlike SGS bonds, SSBs are not tradable at all, and likely will not be transferable between individuals.

SSB investments are cash only, which means CPF funds cannot be used, unlike SGS bonds.

The cap on the investment amount, which MAS will announce later, also renders SSBs less attractive to institutional players with a bigger appetite.

But, of course, SSBs are intended for smaller investors and the MAS does not envision the low-cost retail product catering to institutional investors, it said during the briefing last week.

The big boys are much better served by the existing SGS bonds, the MAS noted.

Wong Wei Han

Published on 5 Apr 2015 Sunday

The Sunday Times - INVEST

No comments:

Post a Comment