Mixed-use development around the station

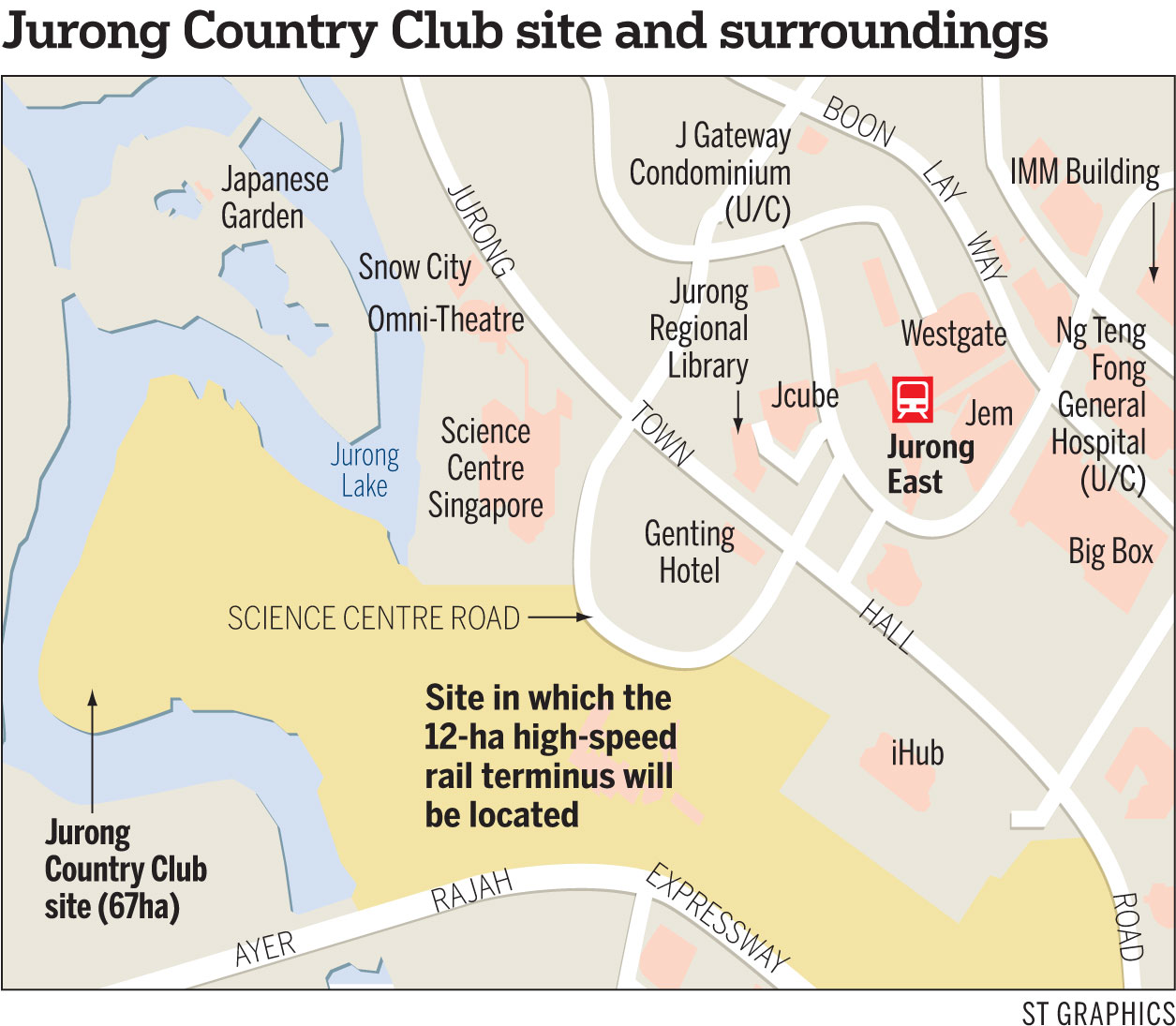

The terminus is expected to take up about 12ha of the 67ha plot the Singapore Land Authority will be acquiring.

It is a sizeable site as the HSR will not exist in "isolation". Supporting infrastructure and amenities are needed, said URA chief executive officer Ng Lang at a briefing. He said URA would develop around the station an "attractive mixed-use development precinct for businesses", with office, hotel, retail and entertainment space.

"The site is very unique and special, fronted by water bodies and greenery. We envisage putting aside some space on the waterfront to develop family-friendly facilities that can complement what we are already planning for Jurong Lake Gardens and the new Science Centre."

However, it will take some time for the urban design to be shaped up, he noted. A master plan will have to consider the site's connectivity to Jurong Gateway and to the rest of Singapore and the greenery as well. "How the area will evolve... depends on the needs of the community and market," he said.

According to the Master Plan 2014, Jurong Gateway has land for about 500,000 sq m of office space, 250,000 sq m for retail, food and beverage and entertainment uses and a further 2,500 hotel rooms. Another 1,000 or more homes are to be added as well. The vision for the precinct was first announced in 2008.

Given these plans, the Jurong Gateway still has plenty of room to grow, said Cushman & Wakefield research director Christine Li.

Current office stock, for example, is just 20 per cent of that amount, while retail is at about 58 per cent. In terms of hotels, only the 557-room Genting Hotel Jurong has opened so far, yet the Master Plan 2014 allows for a cluster of them, said Ms Li.

Residential needs will be partly met when the 738-unit J Gateway, which is fully sold, is completed next year.

More homes could be added, she said.

Prices of private residences and Housing Board resale flats in Jurong East and Lakeside are likely to be boosted by up to 10 per cent closer to the completion of the HSR, with increased leasing demand as well, said R'ST Research director Ong Kah Seng. There could even be a positive spillover effect into Jurong West and Bukit Batok.

Demand could come from more Malaysians working in Singapore and looking to rent rooms here, he said.

While the URA said yesterday that HSR plans "dovetail" with plans to turn the district into a second central business district (CBD), demand for offices in the area is hard to predict, said Savills Singapore research head Alan Cheong. Banks are giving up space in the CBD and even finding business park space in Changi expensive. But there could be demand from manufacturing companies looking to expand here, perhaps reducing their operations in Malaysia at the same time, he said.

Office space in the area has seen decent uptake. Westgate Tower is over 91 per cent committed and joint owners Sun Venture and Low Keng Huat are in talks with a few tenants for the remaining space, Sun Venture managing director Alvin Teo said.

The Ministry of National Development has taken up a master lease at Jem's office tower, while the Agri-Food and Veterinary Authority of Singapore and the Building and Construction Authority have already moved in. About 19 per cent of the building remains vacant.

Ms Li expects the business mix to ultimately be more diverse than in the CBD. "Legal and finance companies may have to be in the CBD due to their client base, but other companies like tech players consider decentralised locations."

Yet, the fact remains that a number of regional centres will be up and competing for occupants at the same time - including Woodlands and Paya Lebar - and the Government will still have to pay attention to vacancy rates in the CBD, added Century 21 chief executive Ku Swee Yong. "There are many contentious issues."

The Straits Times / Top of The News Published on Tuesday, 12 May 2015By Rennie Whang

Mixed-use development around the station

Please click the following for other Related Readings:

Please click the following for other Related Readings:

No comments:

Post a Comment