Strong rental reversions lift Fortune Reit's Q1 performance

Metro Town, a a suburban retail property in Hong Kong manged by Forune Reit.

FORTUNE Reit put in a sterling showing in the first quarter, as asset performance remained solid.

Income available for distribution climbed 12.8 per cent to HK$218.7 million (S$37.6 million), compared with the same period last year.

Net property income rose 12.4 per cent to HK$325 million, compared with a year earlier.

Distribution per unit was 11.63 Hong Kong cents, up from 10.38 Hong Kong cents a year earlier.

The Reit's manager, ARA Asset Management (Fortune), said in a statement yesterday that the exceptional financial performance was mainly because of strong rental reversions across the portfolio and additional income contributions from Laguna Plaza, which was acquired in January.

Rental reversion for renewals stood at 18.4 per cent, with portfolio rent from tenants rising further to HK$37 per sq ft at the end of the first quarter.

Portfolio occupancy also remained strong at 98.1 per cent, as of March 31. On Feb 11, the Reit agreed to sell one of its malls in Hong Kong, Nob Hill Square, for HK$648 million.

This move is equivalent to a 2.9 per cent net property yield and is Fortune Reit's first asset divestment in its 11-year operating history.

The sale price represents a 48 per cent premium over valuation and has resulted in a disposal gain of about HK$215 million.

The disposal was completed on April 2 and net proceeds were used for loan repayment.

The divestment places the Reit in a better position to pursue growth opportunities.

The Reit is currently undertaking an $80 million asset enhancement initiative at Belvedere Square in Tsuen Wan, Hong Kong.

The targeted return on investment for the project is 15 per cent. Fortune Reit units closed six Hong Kong cents lower at HK$7.94 on Friday.

The Straits Times/ Money Published on Saturday, 9 May 2015

By Phyllis Ho hphyllis@sph.com.sg

Strong rental reversions lift Fortune Reit's Q1 performance

Please click the following for other Related Readings:

Please click the following for other Related Readings:

Lakeside project launched in Iskandar

Developers face hefty extension charges over unsold units (Amended)

Govt releases new developer rules on show units, sales data

Changes to Housing Developers (Control and Licensing) Act effective May 25

Government releases EC site in Choa Chu Kang for sale

More companies buying strata offices

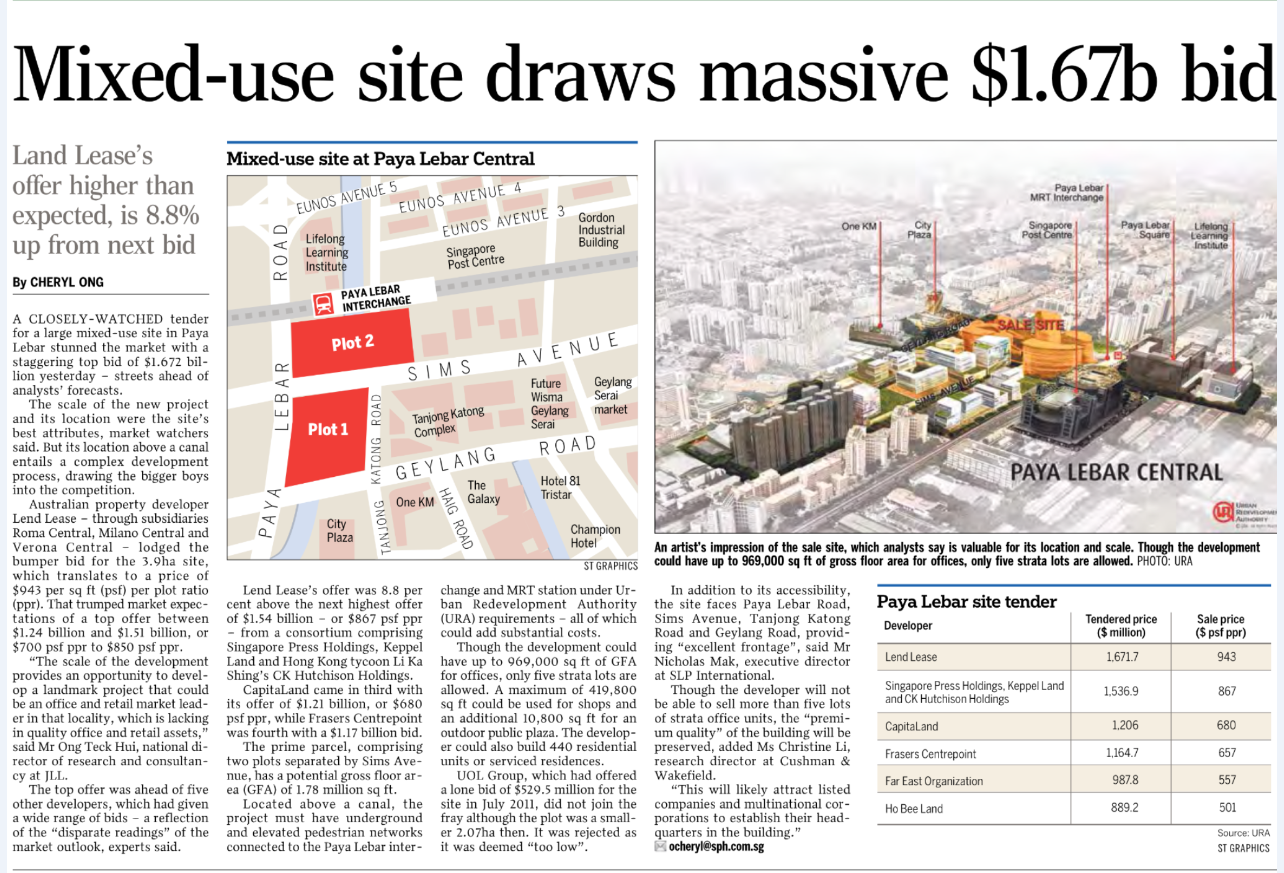

Bids for Paya Lebar site likely to top $1b - Government Land Sale (GLS)

Please Click following LINK for RELATED Post

Please click the following for other Related Readings:

Please Click following LINK for RELATED Post

Please click the following for other Related Readings:

Please Click following LINK for RELATED Post

PLEASE CLICK ON FOLLOWING IMAGES FOR RELATED READINGS

PLEASE CLICK ON FOLLOWING IMAGES FOR RELATED READINGS

Please see and read all his related news. Related Links :

Please see and read all his related news. Related Links :

Please click the following for other Related Readings:

Please see and read all his related news. Related Links :

Please click the following for other Related Readings:

Please see and read all his related news. Related Links :

My Tribute to Mr Lee Kuan Yew - Remembering Lee Kuan Yew - The world should know his stories, his contribution and his final journey - The Legend - He will be in the heart of every Singaporean

My Tribute to Mr Lee Kuan Yew - Remembering Lee Kuan Yew - The world should know his stories, his contribution and his final journey - The Legend - He will be in the heart of every Singaporean

No comments:

Post a Comment