Taxman claws back millions in fraudulent PIC claims

Iras moves to curb abuse of scheme meant to boost productivity

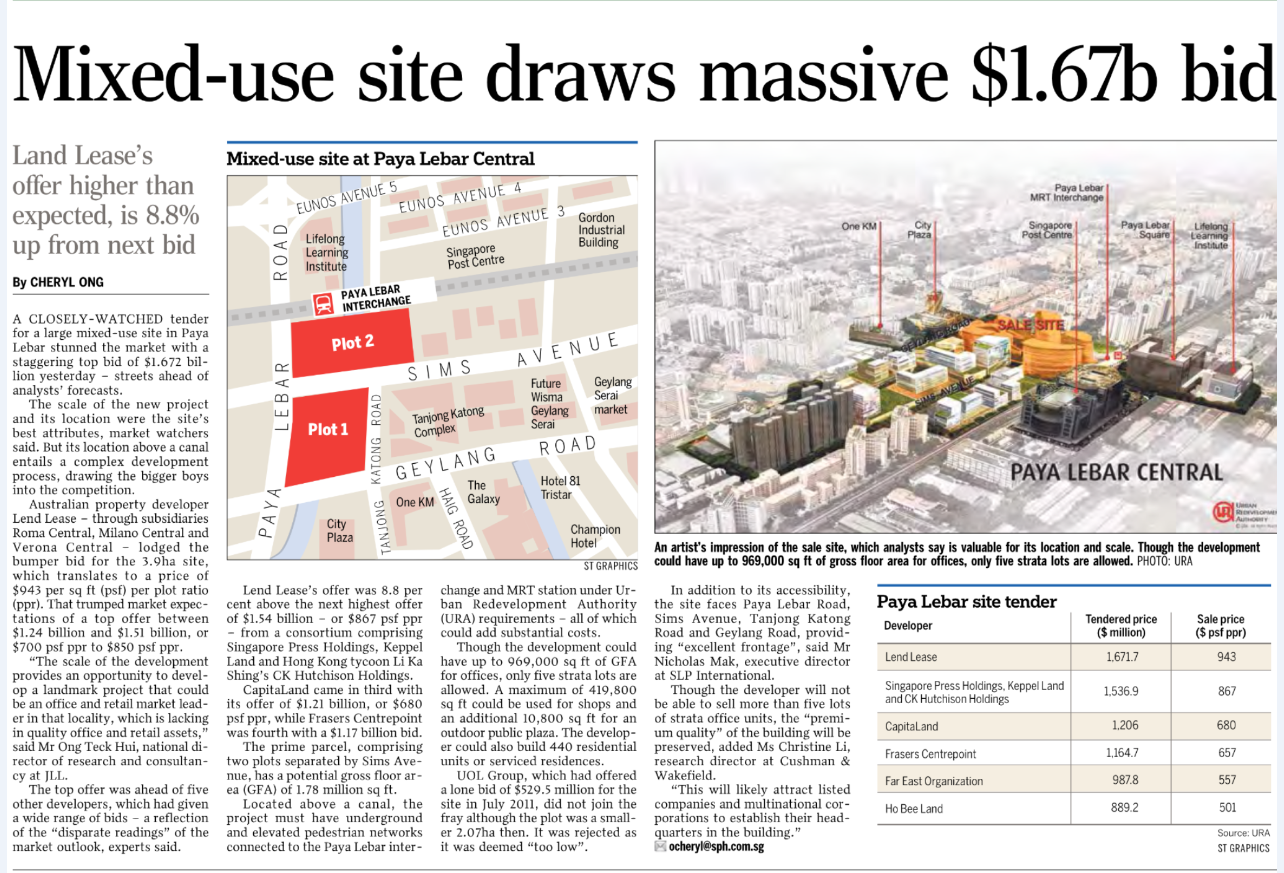

Many firms have benefited from PIC since its launch in 2010. The scheme offers tax deductions or cash payouts to companies that invest in areas such as staff training, IT or automation equipment. -- PHOTO: ST FILE

THE taxman has taken action over 245 fraudulent claims under a wide-ranging scheme that helps companies increase productivity through new technology and innovation.

These wrongful claims under the Productivity and Innovation Credit (PIC) scheme date back to when it was introduced in 2010.

The cash payouts and bonuses clawed back from - or not paid to - these claimants totalled about $10 million as of May 31, the Inland Revenue Authority of Singapore (Iras) said. The amount includes penalties and fines.

Three of the cases are the subject of court cases this month.

One earlier case of abuse involved a company which falsely made a claim for the cash payout for the purchase of computer equipment worth more than $193,000. However, it spent only $1,500 on used computer equipment.

Iras, which administers the scheme, told The Straits Times that it has investigated 471 PIC claims to date.

The PIC scheme offers tax deductions or cash payouts to companies that invest in areas such as staff training, information technology or automation equipment to boost their productivity.

In all, companies have benefited from $2.9 billion in tax savings and cash payouts over the 2011 to 2014 years of assessment, an Iras spokesman said.

The number of companies using the PIC has been steadily growing.

In the 2014 year of assessment, 61,300 firms - or 44 per cent of active companies here - benefited from the scheme.

This is up from 52,500 - or 40 per cent - of active companies in the 2013 year of assessment, and 45,500 - or 37 per cent - of active companies the year before that.

The taxable income for each year of assessment refers to income earned in the company's preceding financial year.

The Iras spokesman said PIC applications "with suspicious characteristics that strongly indicate illegitimate claims" will be rejected upfront unless businesses can prove that they have fulfilled the conditions to qualify.

New laws were introduced last November to curb abuse of the scheme.

Businesses are now required to prove their IT and automation equipment is "in use" before they can claim PIC cash payouts.

Previously, companies just had to show that they had spent the money.

Businesses should also be able to "articulate the equipment's intended use" to Iras, said Senior Minister of State for Finance Josephine Teo during the Parliamentary debate on the law change.

The law also allows the Comptroller of Income Tax to deny PIC benefits to companies engaged in objectionable arrangements which seek to abuse the scheme.

In a report earlier this month, Citi economist Kit Wei Zheng noted that, after Parliament passed the new laws in November, new business formation plummeted.

There had been a surge in businesses set up from March to October last year, a trend some market watchers and policymakers interpreted as a sign of renewed business confidence.

But Mr Kit said this optimism may have been misplaced.

"We had viewed this surge as reflecting new businesses set up to take advantage of generous incentives such as the PIC, not all of which could be involved in wholly productive activities, given incidences of fraudulent PIC claims."

New business formation fell after the regulations were tightened in November and "normalised" to levels seen in 2012 and 2013, Mr Kit added.

Mr Paul Cornelius, a corporate tax partner at PwC Singapore, said that the tweaks to the law "certainly seem to present a barrier to anyone seeking to unfairly take advantage of the scheme".

While it is a challenge to identify every possible kind of potential abuse and every potential perpetrator, regulators typically look for an absence of real commercial purpose and economic substance, he added.

By Chia Yan MinPublished on Jun 29, 2015 8:12 AM

The Straits Times - Monday

Please click the following for other Related Readings:

Alexandra Hospital closes for renovation; Ng Teng Fong General Hospital officially opens today

Alexandra Hospital closes for renovation; Ng Teng Fong General Hospital officially opens today

CapitaLand fulfils conditions to acquire Danga Bay land

Ten industrial sites confirmed for tender

Taxman claws back millions in fraudulent PIC claims

DBSS flat owners at Trivelis may get goodwill package following slew of complaints

Residents of DBSS project Pasir Ris One complain over flaws, lack of corridor space

Pasir Ris One residents complain: Other DBSS projects that made headlines

Comparing corridors across different public housing projects

Sales of 2 condos at Sentosa Cove raise hopes of rebound

Cycling through the Rail Corridor

AHPETC tells residents to pay overdue service fees

New tender for Sengkang temple site draws interest

Task force set up to tackle grouses of Centrale 8 residents

Bukit Panjang LRT system will be upgraded to boost reliability

Corridors of discontent at Pasir Ris One

Freehold redevelopment site in Katong up for tender

33 Parklane basement units for sale

Ten industrial sites confirmed for tender

Taxman claws back millions in fraudulent PIC claims

DBSS flat owners at Trivelis may get goodwill package following slew of complaints

Residents of DBSS project Pasir Ris One complain over flaws, lack of corridor space

Pasir Ris One residents complain: Other DBSS projects that made headlines

Comparing corridors across different public housing projects

Sales of 2 condos at Sentosa Cove raise hopes of rebound

Cycling through the Rail Corridor

AHPETC tells residents to pay overdue service fees

New tender for Sengkang temple site draws interest

Task force set up to tackle grouses of Centrale 8 residents

Bukit Panjang LRT system will be upgraded to boost reliability

Corridors of discontent at Pasir Ris One

Freehold redevelopment site in Katong up for tender

33 Parklane basement units for sale

No comments:

Post a Comment